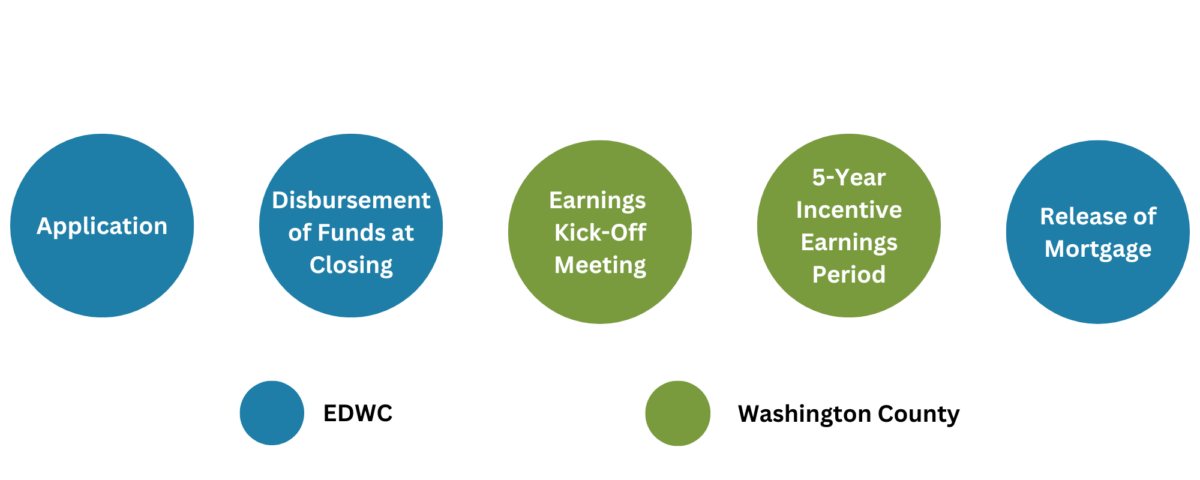

Heart and Homestead Earned Incentive Overview

- Provides a down payment incentive of up to 10% of the home purchase price or $20,000, whichever is less.

- Pre-paid to homebuyers at the time of closing on their home and secured by a subordinate mortgage.

- Earned over a 5-year period through volunteer time and financial donations to nonprofit Participating Agencies.

- There is never any interest or payment schedule for any Unearned Incentive Balance.

- Any Unearned Incentive Balance ONLY becomes due upon certain triggering events; namely future sale of the home (see Incentive Agreement).

- In the event there remains an Unearned Incentive Balance at the time of a bona fide, arm’s length home sale, the obligation is generally limited to available proceeds after satisfaction of approved senior mortgage(s). Other restrictions apply.

Watch Heart and Homestead Overview Video

Not a Typical Homebuyer Incentive

No Income Requirements

Earned Over Time, Paid Upfront

Never Amortizes

Who Can Apply?

An applicant must meet the following conditions:

- Is purchasing an existing or newly constructed, owner-occupied home (including land) for under $420,000 in Washington County that serves as the primary residence.

- Is at least 18 years of age.

- Has been pre-qualified or pre-approved by the lender for either:

- Fixed Rate Mortgage.

- Adjustable Rate Mortgage with a 3 years or greater fixed rate prior to the first rate adjustment.

- Construction Mortgage Loan, pre-approved for end financing that is either a Fixed Rate Mortgage or an Adjustable Rate Mortgage with a 3 years or greater fixed rate, prior to the first rate adjustment.

- Passes a criminal background check.

- Has never previously received this incentive.

How Can Funds Be Used?

- Down payment on constructing a new home (must have a construction contract & either own or have an accepted offer on the land).

- Down payment on purchasing a newly-constructed home.

- Down payment on purchasing an existing home.

- Renovation costs (including remodeling and upgrades to a home that is both new to the recipient and habitable).

- Closing costs, including points with limitations (see below).

- Escrow reserves.

Note: Funds may not be used to re-finance.

Application Review

Submission Requirements

- Complete online application.

- Submit mortgage lender prequalification letter (incentive may be a contingency).

- Pay $100 non-refundable/non-transferable fee.

EDWC Team

- Reviews application & submissions to verify eligibility.

- Poses any follow-up questions with mortgage lender or applicant.

- Addresses application issues, if any.

- Sets up the background check.

View Background Check Details

Approval Letter

Once issued by the EDWC team, the approval letter is valid for 90 days. If the approval letter expires, applicants will need to re-start the process by submitting a new application and fee.

Once applicants obtain an accepted offer to purchase or an executed construction contract, applicants have another 60 days to close and can request up to 4 extensions during this pre-close period.

Amending the Approval Letter

Under certain conditions, the approval letter may be amended:

- In the event the applicant did not get an accepted offer on the home intended to purchase/construct when originally completing the application and now has identified a new home to purchase/construct.

- The home’s purchase/construction price has changed.

Pre-Closing Punch List

Applicant

Applicant

>> Lender’s pre-approval letter

>> Fully executed offer to purchase / construction contract

>> Executed Incentive Agreement

Lender

Lender

>> Commitment for title insurance (naming lender)

>> Appraisal (as built if new construction)

>> Loan Estimate

>> Lender Certification form

>> Homeowner’s Policy Binder (naming Washington County as Second or Third Mortgagee as applicable)

>> Closing Disclosure

Title Company

Title Company

>> Wire instructions on appropriate letterhead

Closing / Disbursement

- EDWC will verify and document prior to close applicant is paying less than $420,000 for the home (dwelling unit and land collectively). In the event the applicant is constructing a new home on land they already own, the sum of the cost to construct the home and the assessed value of the land must be less than $420,000 in order to satisfy this requirement.

- The Incentive must be specifically incorporated into the Loan Estimate and Closing Disclosure (see Lender Tips).

- Lender will be responsible for ensuring Washington County is named within the homeowner’s policy binder (see Relevant Documents).

- Upon receipt of all required documentation (including and especially a fully executed Incentive Agreement), EDWC will wire funds to the title company.

- EDWC will provide lender with a completed Standard Form Second Mortgage ready for execution.

- Lender will be responsible for building the second mortgage filing fee into the closing costs and having the recipients sign the second mortgage and file it in the appropriate order.

- EDWC and Washington County staff reserve the right to attend closings to support finalization of documents and /or for promotional purposes.

Lender Tips

- Incentive funds used for down payment assistance (top Heart and Homestead objective) would appear on Page 3 of the Loan Estimate and Closing Disclosure as part of the total “Down Payment / Funds from Borrower” in the Calculating Cash to Close section.

- EDWC would additionally expect to see that the total amount of incentive funds appear on Page 3 of the Loan Estimate and Closing Disclosure in the Summaries of Transactions, Section L as a separate line item referencing the incentive specifically.

- Closing costs, including points (with limitation…see below), are also an eligible use of incentive funds.

- In keeping with mission and priority objectives, incentive funds used toward points:

- May only be used for the purpose of a permanent rate buy-down. Temporary buy-downs are not a permitted use of this incentive.

- May only be applied toward up to 25% of total points.

- Should appear on Page 2 of the Loan Estimate and Closing Disclosure under Loan Costs, Section A in the “Paid by Others” column.

- If incentive funds are used for other closing costs, EDWC would expect to see them on Page 2 of the Loan Estimate and Closing Disclosure in the relevant cost line item under the “Paid by Others” column.

Treatment of Earned and Unearned Incentive Amounts

Is the Earned Portion of the Incentive Taxable?

While every Recipient should consult their tax advisor to determine tax implications for themselves, the total value of the incentive is generally not considered taxable income at the time of disbursement since it is an unearned incentive obligation secured by a junior mortgage. Recipients will, however, receive a 1099-G annually from Washington County for the portion of the incentive that they actually earned (accrued) over the previous year through volunteer service and or financial contributions to eligible entities. These earnings represent reportable grant income for the purposes of the IRS.

Does the Recipient Ever Owe the Unearned Incentive Balance?

The Unearned Incentive Balance must be repaid, with limitation, in the event any of the following were to occur:

- The home is no longer the recipient’s primary residence.

- The home is sold or transferred to a third party.

- Refinancing occurs without EDWC consent.

- Total aggregate debt exceeds initial balance of first mortgage and, if applicable, government supported homebuyer assistance second mortgage.

- Fraud and/or misrepresentation in the application.

- Breach of Incentive Agreement.

Repayment Event Other than Sale of Home

Obligation owed in full.

Selling of Home

Obligation shall be limited to the excess of the purchase price to be paid for the Home (after standard closing adjustments) over the then outstanding balance of any approved senior debt secured by a first and, if applicable, second mortgage on the Home.

Refinancing & Subordination

The incentive is prepared to assume a changed subordinate position to accommodate various eligible situations such as a homeowner modifying their existing mortgage, selling to the secondary market, refinancing to a lower rate or obtaining a HELOC (with limitation). Here is what the process would look like in the event such a need occurs:

-

- Lenders will contact EDWC requesting a modified subordination, providing an explanation.

- EDWC will review the request and determine if it is eligible per the Incentive Agreement.

- If yes, EDWC will ensure that the total aggregate debt secured by mortgages on the Home do not exceed the sum of the initial balance of the first mortgage loan from Lender and, if approved at the time of application, the initial balance of a government supported homebuyer assistance second mortgage incurred by the Recipient upon acquisition of the Home.

- We will also confirm that Heart and Homestead’s junior mortgage would not slide any further than a third position.

- EDWC will then provide the Lender with a standard form Mortgage Subordination Agreement.

- There is a $250 pass-through charge that EDWC will ask Lenders to assess the Recipient at close, incorporating this charge into the closing statement.

Positioning for the Secondary Market GSEs

When packaging a mortgage for the secondary market, lenders should code the Heart and Homestead incentive as a Community Seconds® subordinate mortgage. While not purchased by the GSEs, Community Seconds® are required to meet certain criteria when they are subordinate to first mortgages purchased by Fannie Mae or Freddie Mac. When they do, they are accepted by these GSEs as a tool for prospective home buyers to overcome barriers to ownership by addressing upfront costs associated with the mortgage transaction, including down payments and closing costs. Also, when repayment of the Community Seconds® is deferred for five years or more, a lender is not required to include a monthly payment for the Community Seconds® in its calculation of the borrower’s debt-to-income ratio. This is the case for Heart and Homestead.

We encourage lenders to review this criteria checklist provided by Fannie Mae as part of seeking to establish underwriter confidence that the GSEs will accept a first mortgage with a Heart and Homestead subordinate mortgage attached as a Community Seconds®. Specifically, a Washington County Heart and Homestead Down Payment Incentive approved and awarded by EDWC – with its subordinate second mortgage securing the incentive’s disbursement at close – meets all the “Yes” criteria referenced here by virtue of both Heart and Homestead’s eligibility requirements and how Heart and Homestead is structured through the incentive agreement. The Heart and Homestead Community Seconds® subordinate mortgage does not include any resale restrictions.

Lenders can find further information on Community Seconds® eligibility in the Seller Guides of the respective GSE’s in the following sections:

- FNMA / MPF – B5-5.1-02

- FHLMC – 4204.2